Continuing Deduction Caps

Updates to post-tax deduction types that prevent maximums from resetting annually.

Continuing Deduction Caps

Previously, the cap maximums on the post-tax deduction types Child Support, Garnishment, and Tax Levy reset annually. As a result, regardless of how much an employee paid toward these deductions, their balance would reset at the beginning of a new calendar year, which is not always the desired or expected behavior.

To address this, we’ve created four new deduction types in Namely Payroll with cap maximums that will not reset annually:

-

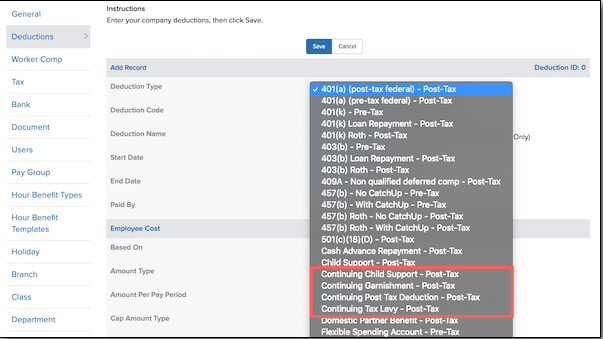

Continuing Child Support (Post-Tax)

-

Continuing Garnishment (Post-Tax)

-

Continuing Tax Levy (Post-Tax)

-

Continuing Post Tax Deduction (Post-Tax)

-

The Continuing Post Tax Deduction is a brand new deduction type that can be used for any post-tax deduction with a cap that should not reset annually.

-

Note: The non-continuing versions of the Child Support, Garnishment, and Tax Levy deduction types have not been removed. The caps on these deduction types will continue to reset annually. Make sure you select the correct deduction type based on your needs when setting up deductions for employees.

Creating and Assigning Continuing Deduction Types

When creating deductions at the company-level in Payroll, the new deduction types appear in the Deduction Type dropdown menu.

-

Note: You must create a deduction at the company-level before you can assign it to an employee.

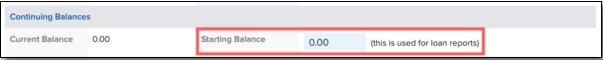

When assigning the deduction to an employee, enter the total remaining balance for the deduction in the Starting Balance field under Continuing Balances.

-

Note: While the field is titled Starting Balance, if a deduction (for example, a tax levy) has previously been partially paid down and is being transferred from another payroll provider or EIN, only enter the remaining balance, not the starting balance before any payments were made.